So, while we all thought that as we rang out 2020 and embraced 2021 that our lives would return to some sort of normality – whatever the new normality looked like. Fast forward a few days in and our worlds changed again with the announcement of a Tier 5 (National Lockdown) to resemble what we first experienced in March 2020 across the UK, Scotland and Ireland. The saddest part is that as we have seen on the news all week that the number of positive cases with the new strain of virus and sadly deaths is continuing to increase rapidly. So as much as we find ourselves at home again, the annual employment legislation changes in 2021 goes on.

Covid Testing – Lateral Air Flow Tests

As the new strain of the virus is affecting us all in both our personal and professional lives and as many people do not have any symptoms and are therefore asymptomatic, in addition to the NHS testing where employees who do have symptoms can access, you can also purchase Lateral Air Flow tests via a number of online suppliers such as https://www.ppeonlineshop.co.uk and, the cost is very reasonable to purchase test kits.

Some clients are not able to ensure that the social distancing or mask wearing can be incorporated into their operation which is part of the H&S risk assessments, so this is an alternative that can be implemented to identify positive cases in the workforce, reduce risks and identify employees who in fact do have the virus, but have no symptoms and therefore manage the spread of the virus. The lateral air flow tests are similar to the NHS testing but the results are available within approximately 1 hour of taking the test.

GDPR has to remain paramount whilst undertaking testing and in particular around the processing of data. We are currently gathering information on GDPR Covid data and will send a further newsletter on this and whether it is deemed as a reasonable management instruction to have a test.

EU Data Protection Extension – 6 month

The arrangement which was agreed over the Christmas period extends the current data protection arrangements regarding the transfer of data between the UK and the EU/EEA for 6 months.

This means that businesses in the EU/EEA will still be able to safely transfer personal data to the UK without the need for the additional safeguards to be in place. The arrangement is for 6 months to allow for adequacy decisions to be made. An adequacy decision is a formal assessment by the EU that a non EEA organisation or state has adequate data protection provisions.

Where one has been made for a country, data can be transferred to that country without further requirements. As the UK currently operates under the GDPR, and therefore the same rules as the EU, an adequacy decision should in theory be a formality.

Furlough extended till April 2021 – impacting your employees

We have already issued updates on the extended furlough scheme now in place till the end of April 2021 in our previous newsletters. As the Government has now indicated that schools, colleges and universities will not reopen until after the February half term and the reintroduction of remote learning (nurseries are currently open as are school provisions for children of key workers and those deemed vulnerable), employers are experiencing an increase of parents who are asking to be furloughed as they cannot find adequate or alternative child care. You can of course consider this and, it is an option available to you, but there is no entitlement as appears to be the opinion of some employees.

However, there are other alternatives that you could consider which includes providing flexibility in the hours that they work, so that parents and carers can try to continue to work their contractual hours albeit while trying to juggle school work/caring provisions.

If by working together with your staff you can ensure that the operational needs are met, client service remains at the forefront, but providing more flexibility in the hours that they are working (i.e. work some of their hours during the day and then work some later in the evening), it could be a win win for both.

We also know that people deemed as clinically extremely vulnerable have been advised to “shield” and those that fall within that group have been issued with letters/text messages/emails regarding the shielding and those communications can be requested by you as the employer for placing on the individual’s HR file. If the employee in receipt of a shielding notification cannot work from home, it is an option for you as the employer to furlough them. Also, worth noting and unlike the previous lockdown the furlough rules are not now extended to those in the same household as shoes shielding, but only for those caring for vulnerable people in their household/home.

We also need to think about general well being for those employees not only on furlough, but for those who are still working. How do we as leaders keep morale and motivation up, when January even in normal times is one of the most depressing, now even more so with the fact that leaving the house is now only for exercise, essential shopping, etc. Very different from the summer months and the lovely weather when dog owners were begging NOT to be taken out, and kids DIDN’T want to go the park again!!!

Pregnant employees NEW GUIDANCE

On the 23 December 2020 an important guidance was introduced relating to pregnant employees which can be found on the following link;

Set out in this guidance which we have extracted below relates to those women who are less than 28 weeks pregnant and those that are more than 28 weeks. As an employer your responsibility for H&S and duty of care is paramount that you understand and implement such RA’s and alternative duties, or consider furlough/suspension on medical grounds.

Introduction

This advice is for you if you are pregnant and working as an employee. This includes pregnant healthcare professionals. It will help you discuss with your line manager and occupational health team how best to ensure health and safety in the workplace.

If you are pregnant and have let your employer know in writing of your pregnancy, your employer should carry out a risk assessment to follow the Management of Health and Safety at Work Regulations 1999 (MHSW) or the Management of Health and Safety at Work Regulations (Northern Ireland) 2000. This may involve obtaining advice from the occupational health department. See the workplace risk assessment guidance for healthcare workers and for vulnerable people working in other industries.

Information contained in the RCOG/RCM Guidance on coronavirus (COVID-19) in pregnancy should be used as the basis for a risk assessment.

Pregnant women of any gestation should not be required to continue working if this is not supported by the risk assessment. Pregnant women are considered ‘clinically vulnerable’ or in some cases ‘clinically extremely vulnerable’ to coronavirus (COVID-19), and therefore require special consideration as contained in government guides for different industries.

The following recommendations apply for women less than 28 weeks pregnant with no underlying health conditions that place them at a greater risk of severe illness from coronavirus (COVID-19)

You must first have a workplace risk assessment with your employer and occupational health team.

Then, you should only continue working if the risk assessment advises that it is safe to do so.

This means that your employer should remove or manage any risks. If this cannot be done, you should be offered suitable alternative work or working arrangements (including working from home) or be suspended on your normal pay.

Your employer should ensure they are able to adhere to any active national guidance on social distancing.

Some higher risk occupations such as those with greater public contact or in healthcare may carry a higher risk of exposure to the virus. In healthcare settings this may include working in specific higher risk areas or higher risk procedures as summarised in the Public Health England publication Guidance on Infection Prevention and Control.

You should be supported by your employer with appropriate risk mitigation in line with recommendations to staff arising from workplace risk assessment.

If alternative work cannot be found, advice on suspension and pay can be found in HSE guidance.

The following recommendations apply for pregnant women who are 28 weeks pregnant and beyond or with underlying health conditions that place them at a greater risk of severe illness from coronavirus

If you are 28 weeks pregnant and beyond, or if you are pregnant and have an underlying health condition that puts you at a greater risk of severe illness from COVID-19 at any gestation, you should take a more precautionary approach.

This is because although you are at no more risk of contracting the virus than any other non-pregnant person who is in similar health, you have an increased risk of becoming severely ill and of pre-term birth if you contract COVID-19.

Your employer should ensure you are able to adhere to any active national guidance on social distancing and/or advice for pregnant women considered to be clinically extremely vulnerable (this group may previously have been advised to shield).

For many workers, this may require working flexibly from home in a different capacity.

All employers should consider both how to redeploy these staff and how to maximise the potential for homeworking, wherever possible.

Where adjustments to the work environment and role are not possible (e.g. manufacturing/retail industries) and alternative work cannot be found, you should be suspended on paid leave. Advice on suspension and pay can be found in HSE guidance.

End of Free Movement – Brexit 31 December 2020

As you all know (how could you have escaped the news) the UK finally got a deal as we got ready to leave the EU on 31 December 2020. Our last editorial in 2020 covered the settled/pre settled status for your employees, that if you haven’t already done so should be undertaken with some urgency. Any guidance that you need on this, please contact us. As an employer you have until the end of June 2021 to determine the status of your employees.

Also please note that UK Nationals travelling to the EU, if they want to stay more than 90 days in a 180-day period will require a visa to do so.

Gender Pay Gap (GPG) Reporting by 4 April 2021

The next reporting deadline currently is the 4 April (for the 2020/2021 reporting year) and despite everything going on currently there isn’t any suggestions that this will be delayed. For organisations with 250 employees or more in Great Britain you should now be preparing to complete your reporting by this date. If this affects your business and you would like further guidance on this reporting, please contact us. For employers who may have a smaller workforce than the current required 250 employees, please note that a Private Member’s Bill has been introduced into the House of Commons to reduce the headcount down to 100 or more employees, but as of yet this has not been passed.

IR35 6 April 2021

The postponed IR35 new legislation from April 2020 comes into effect on the 6th. Black Mountain published an editorial on this in the later part of 2020. If you would be interested in re-receiving a copy, please contact one of the HR team.

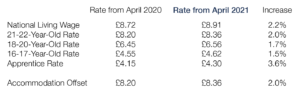

National Minimum Wage Rates 6 April 2021

Our payroll team will be creating and issuing a more detailed newsletter on all the payroll changes afoot, but for efficiency the NMW increases are as follows;

NOTE; National Living Wage normally for aged 25 and over has been lowered to age 23 and over from April.

SMP/SAP/SPP/SHPP/SSP Rates 4 & 6 April 2021

The current weekly rate of statutory maternity pay (SMP) is £151.20, or 90% of the employee’s average weekly earnings if this figure is less than the statutory rate.

The rate of statutory maternity pay is expected to rise to £151.97 from April 2021. The increase normally occurs on the first Sunday in April, which in 2021 is 4 April.

Sunday 4 April 2021 also sees the first annual increase for statutory parental bereavement pay. This follows the introduction of the right to parental bereavement leave, available to the parents of a child who died on or after 6 April 2020.

Also, on 4 April 2021, the rates of statutory paternity pay (SPP) and statutory shared parental pay (SHPP) are expected to go up from £151.20 to £151.97 (or 90% of the employee’s average weekly earnings if this figure is less than the statutory rate).

The rate of statutory adoption pay (SAP) increases from £151.20 to £151.97.

This would mean that, from 4 April 2021, statutory adoption pay is payable at 90% of the employee’s average weekly earnings for the first six weeks, with the remainder of the adoption pay period at the rate of £151.97, or 90% of average weekly earnings if this is less than £151.97.

The rates normally increase each April in line with the consumer price index (CPI).

The rate of statutory sick pay (SSP) is also expected to increase from £95.85 to £96.35 on 6 April 2021.

To be entitled to these statutory payments, the employee’s average earnings must be equal to or more than the lower earnings limit.

However, the lower earnings limit from April 2021 has not yet been published – it is listed on the government’s announcement as “TBC”.

New legislation

In December 2019 the Queen’s speech heralded several proposed pieces of legislation. Some of these may have been overtaken by the events of the last nine months, but the key ones are;

Extension to redundancy protections to prevent pregnancy/maternity discrimination

There is a popular myth that you cannot make those on maternity leave redundant. This is not correct. While you must not make them redundant because they are on maternity leave, you must treat all employees fairly and equally, which means including those on maternity leave in a pool with colleagues. However, if they are selected for redundancy while on maternity leave then a woman has enhanced rights to be placed into a vacant role for which they have the skills without competitive interview. The government intends to extend that protection for six months after the woman returns from maternity leave.

Introducing an entitlement to one week’s leave for unpaid carers

In March 2020, the government issued a consultation paper and asked for responses by 3 August 2020. In this paper they proposed allowing unpaid carers to have an additional one week unpaid leave a year. The response to this consultation has not yet been published.

Allowing parents to take extended leave for neonatal care

Following consultation in 2019, the government published a response in March 2020 confirming that parents of babies that are admitted into hospital as a neonate (28 days old or fewer) will be eligible for neonatal leave and pay if the admission lasts for a continuous period of seven days or more. They will be entitled to this from day one of their employment and up to a maximum of 12 weeks. There have been no further details published, including the level of the neonatal pay.

Making flexible working the default unless employers have a good reason not to

This proposal, introduced in 2019 under the flexible working bill by Conservative MP Helen Whately, failed to complete its passage through parliament by the end of the session, which means it will not progress. However, although the Queen announced that legislation would be implemented to give effect to this, it is likely to have been overtaken by the events in recent months. All employers have been forced to look at whether their employees can work from home, with some having to juggle childcare as well as do their jobs, and a lot of myths and preconceived ideas have been firmly put to rest.

A new, single enforcement body for employment rights

Consultation closed in October 2019 and as yet no further details have been published, but the intention is to have one body enforcing minimum wage, unpaid tribunal awards and the tribunal penalty scheme, regulating statutory sick pay and publicising employment rights.